7.3. Conceptual Architecture of DeflationCoin

Last updated

Last updated

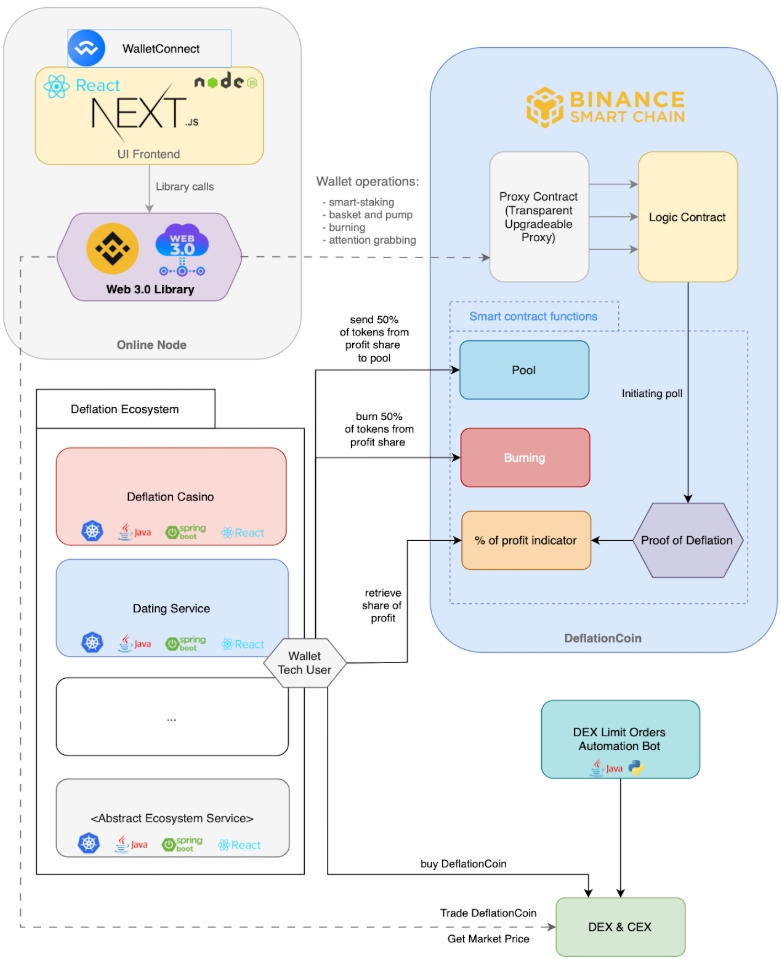

The DeflationCoin project is based on a flexible and scalable architecture that combines the decentralized technologies of the Binance Smart Chain blockchain and a microservice-based design. The architecture consists of three main modules: the DeflationCoin cryptocurrency built on Binance Smart Chain, the online node that serves as the user's personal dashboard and the deflationary ecosystem. The key system modules and their interactions are depicted in the diagram below.

DeflationCoin is the central element around which all interactions within the deflationary ecosystem are built. The token’s smart contract ensures the execution of core functionalities, ranging from transaction processing to implementing deflationary mechanisms. Interaction is primarily driven by invoking smart contract methods, enabling transaction creation, staking management, profit distribution, token burning and other processes essential to ecosystem functionality.

User interaction with the token begins with the online node, which provides a personal dashboard for viewing the current balance, sending tokens, accessing transaction history, managing staking, and obtaining portfolio insights. These features are implemented through smart contract method calls. When a user stakes tokens, a transaction is initiated that calls the smart contract method to lock the tokens for a specific period and allocate corresponding dividends. Similarly, staking positions, transaction history, or interest accrual data are accessed via contract methods, ensuring decentralized and transparent data processing. The online node also supports token trading through integration with decentralized exchanges (DEX).

Each element of the ecosystem, whether it’s educational gambling or a dating service, generates profits that are partially redirected back into the system. A dedicated smart contract method is invoked to allocate a portion of this revenue to token burning and dividend pool contributions. This method returns results used to automate subsequent processes. For example, if an ecosystem element generates a certain amount of profit, the technical wallet purchases tokens on exchanges (DEX or CEX) using fiat funds, after which token-burning and dividend-pool replenishment processes are initiated.

Automatic token burning is an integral part of the architecture. The burning process is triggered by calling a smart contract method, which destroys a specific percentage of tokens from circulation. This consistently reduces the total token supply in the system, creating deflationary pressure and driving up token value. Simultaneously, another portion of the profits is directed to the dividend pool, used to distribute rewards among token holders. Pool management is also handled through smart contract functions, ensuring the allocation and withdrawal of funds for participants.

To ensure stable token trading and liquidity management, an automated trading bot has been implemented. This bot integrates with exchanges via APIs and automatically places limit sell orders for tokens. The bot uses data and price parameters described in Section 3.13, “Geometric Progression of Token Distribution.”

The following subsections will delve deeper into the architecture of each project module.